While preparing Regular Return, the challan(s) can be fetched from either TRACES or IT Portal.

- To fetch it from TRACES the user has to be provide the challan amount which will be validated with the actual amount and fetched.

- To fetch it from the Income Tax Portal the user has to provide the date range i.e. the From Date and To Date and this date range can be for a maximum period of 4 months. Further, as per rules the challans can be extracted only for the current and previous financial year.

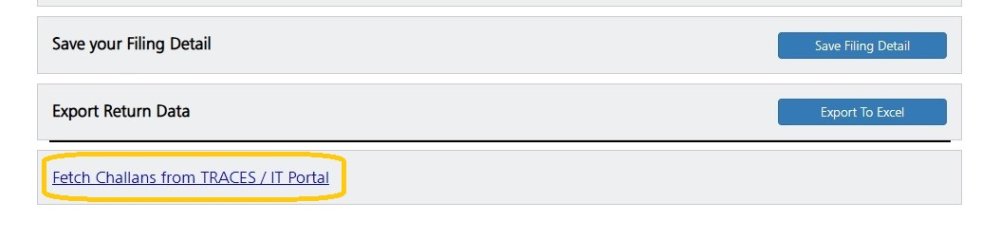

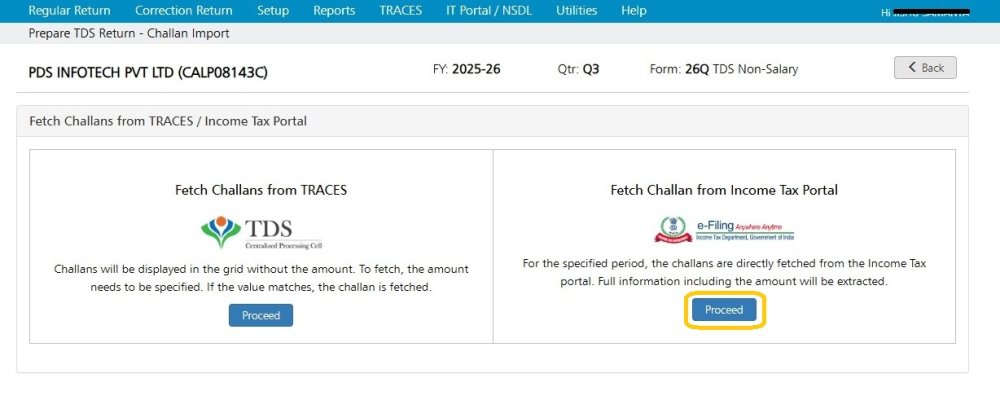

In order to extract the challans, click on ‘Fetch Challans from TRACES / IT Portal’ on ‘Regular Return’ screen, as shown below :

The following screen will get displayed:-

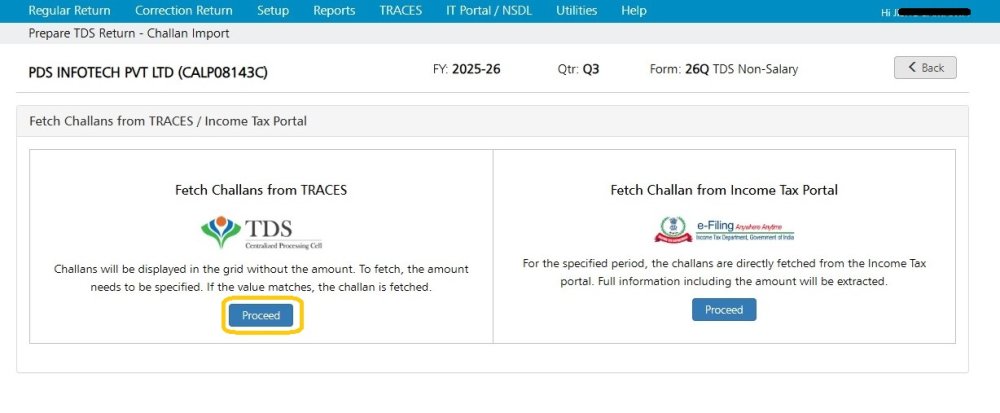

To fetch the challans, click on either

- Fetch Challans from TRACES

- Fetch Challan from Income Tax Portal

Fetch Challans from TRACES

In order to fetch challans TRACES, click on ‘Fetch Challan from TRACES’ as shown below:

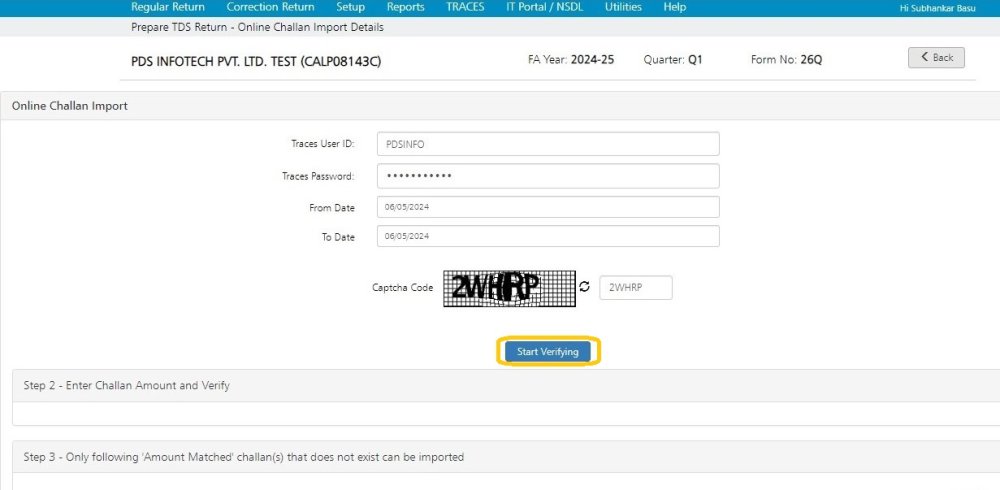

The TRACES Credentials have to be entered. Provide From Date and To Date. Enter the Captcha code and click on ‘Start Verifying’.

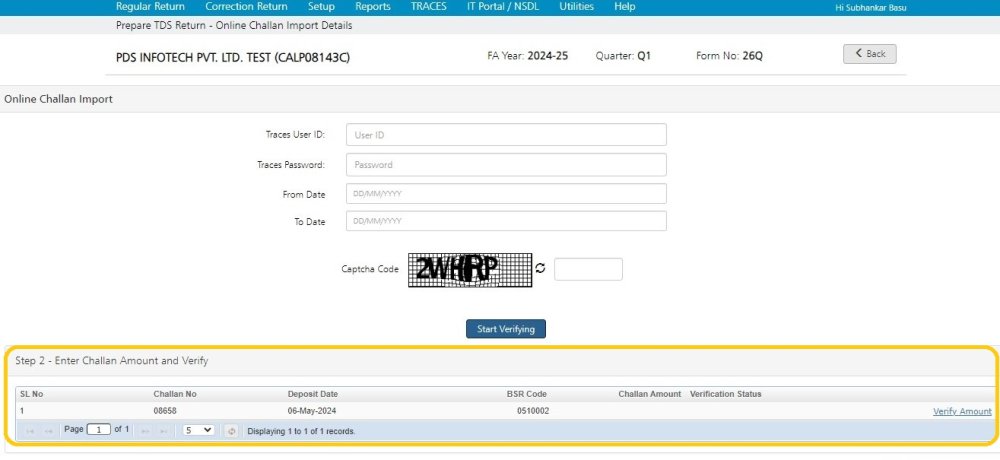

All the challans within the given date range will get displayed, as shown below:

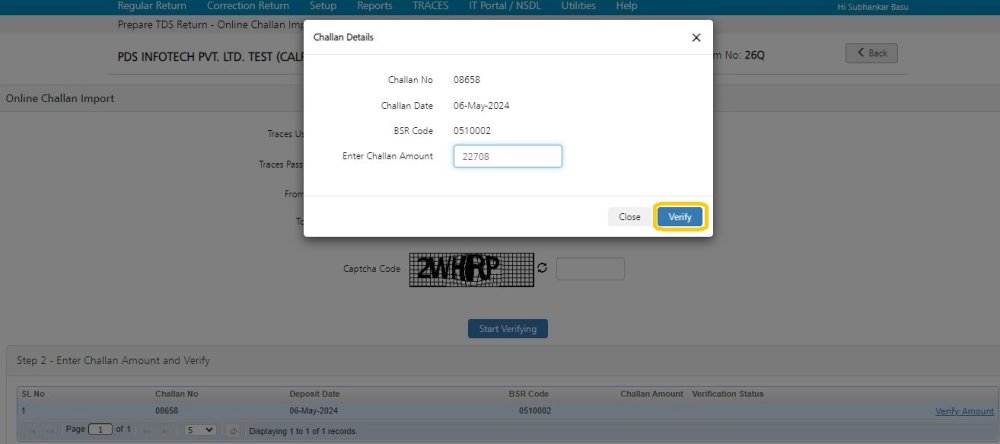

In order to verify the challans, the user needs to click on ‘Verify Amount’ of the individual challan. The following screen will get displayed:

The user needs to enter the Challan Amount and click on ‘Verify’. Once the verification is done, the system will display the status of the same, as shown below:

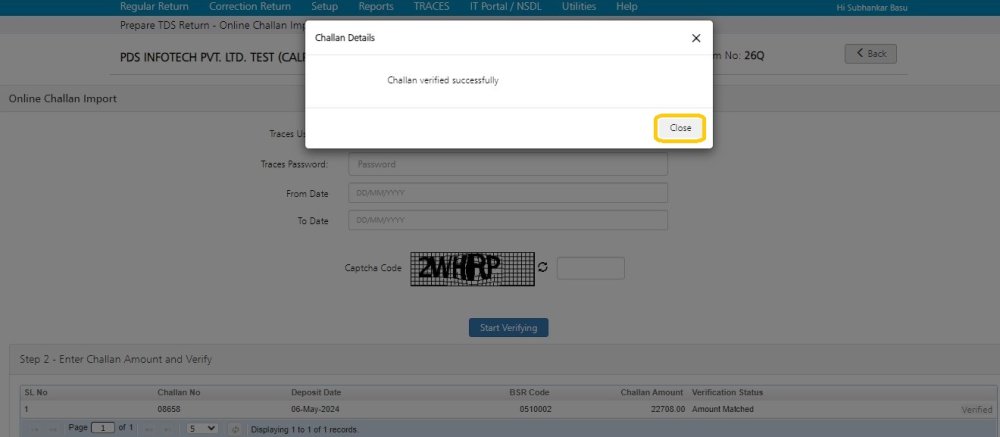

In this case the challan verification is successful. Click on ‘Close’.

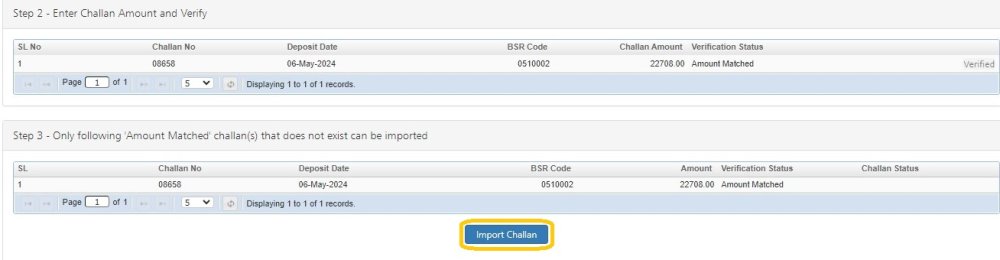

Similarly, all the challans can be verified. After successful verification of each challan, the challan(s) can be imported in the CA-TDSMAN software.

Please note, that only the challans which do not exist in the system will get imported.

Click on ‘Import Challan’ as shown below:

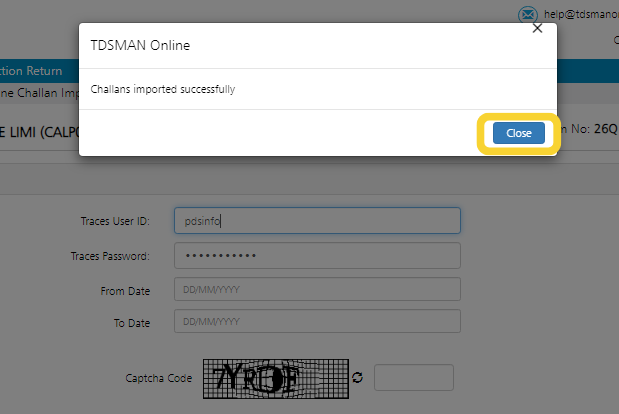

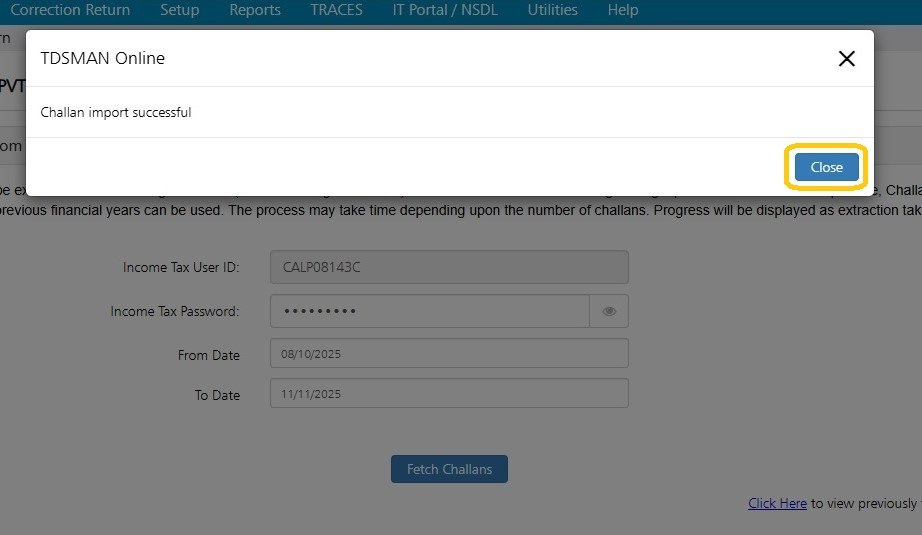

On successful importing of challan, the message for the same will get displayed as shown below:

Fetch Challan from Income Tax Portal

In order to fetch challans from the IT Portal, click on ‘Fetch Challan from Income Tax Portal’ as shown below:

Click on ‘Proceed’.

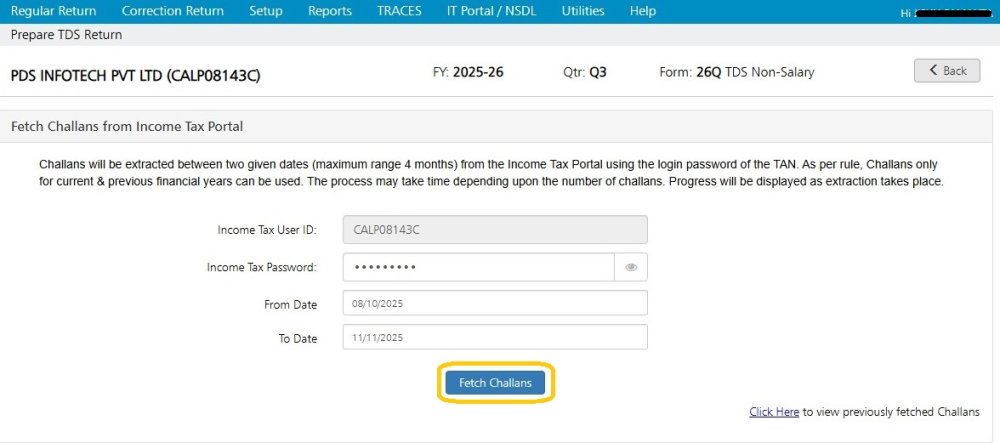

The following screen will get displayed :

The Income Tax Portal Credentials have to be entered. TAN is the Income Tax User Id.

Provide From Date and To Date. This date range can be for a maximum period of 4 months. Further, as per rules the challans can be extracted only for the current and previous financial year.

Click on ‘Fetch Challan’.

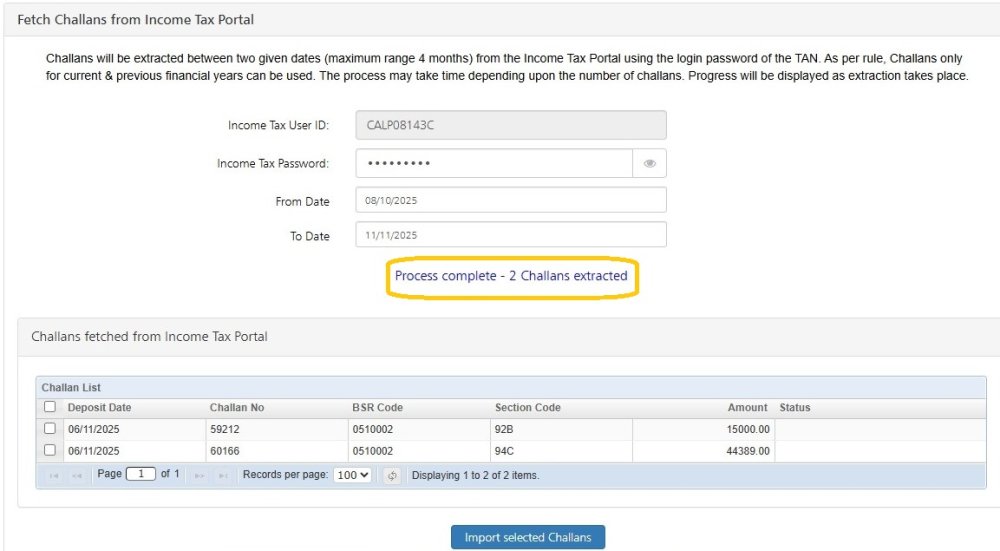

The extraction process may take time depending upon the number of Challans.

Progress will be displayed as extraction takes place.

All the challans within the given date range will get extracted and displayed, as shown above.

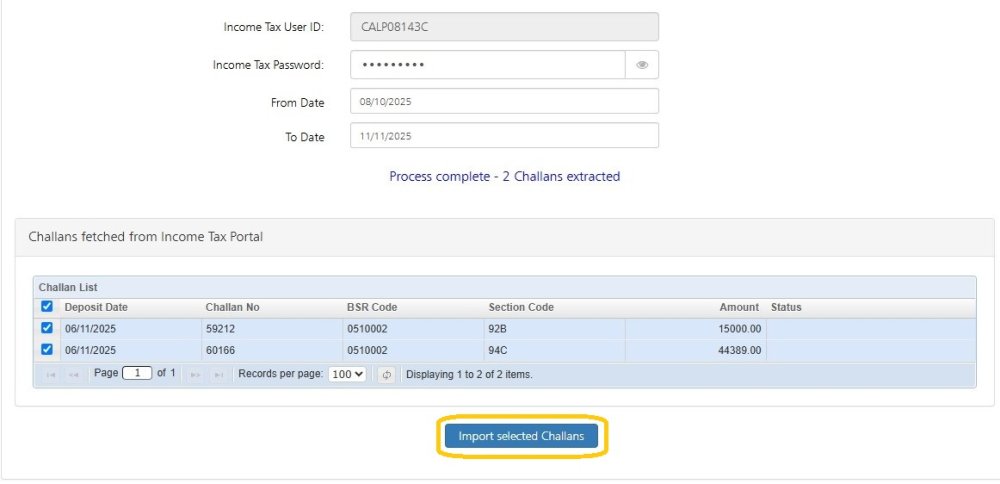

In order to import the challans, select the relevant challans.

Click on ‘Import selected Challans’, as shown below:

Once Challan got imported successfully below screen will come

On successfully import, click on ‘Close’

Need more help with this?

TDSMAN Online - Support