The software provides the facility to view the TDS/TCS rates applicable for the various sections for a particular financial year.

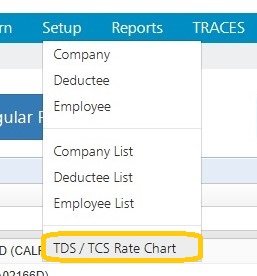

In order to view this, click on Utilities >TDS/TCS Rate Chart

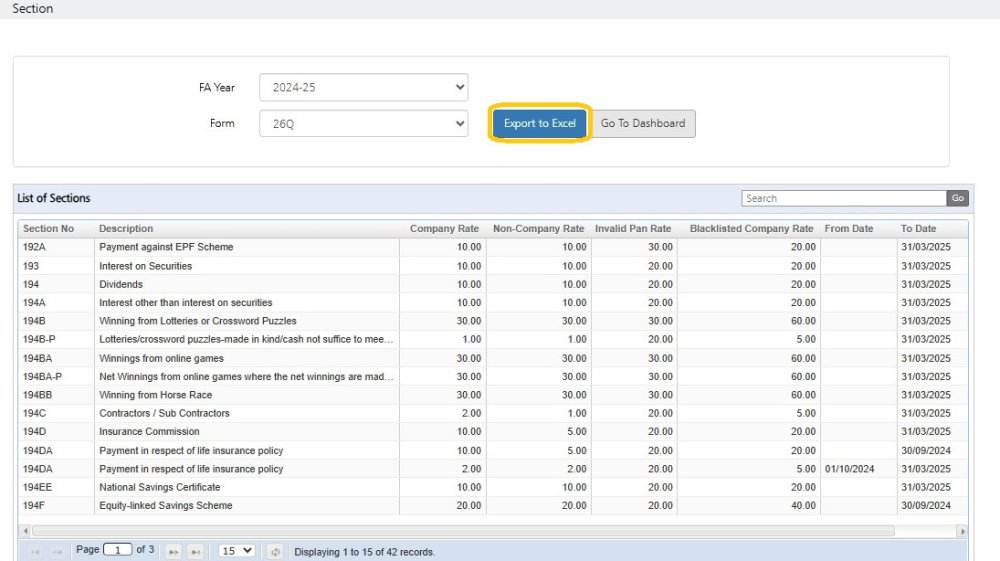

The following screen with the rate details will get displayed :

FA Year: By default, the current Financial Year will get selected. However, it can be changed as per requirement.

Form: By default, Form 26Q will get selected. However, it can be changed as per requirement.

Export to Excel: The system gives the facility to export the data into an Excel file.

Need more help with this?

TDSMAN Online - Support