TDS needs to be deducted for payments made overseas, and the return needs to be submitted in Form 27-Q. For certain specific remittances, Government of India has a Double Taxation Avoidance Treaty which is called DTAA which is country specific. For different types of remittances, the rates may be same or different.This module gives you the option to view these rates.

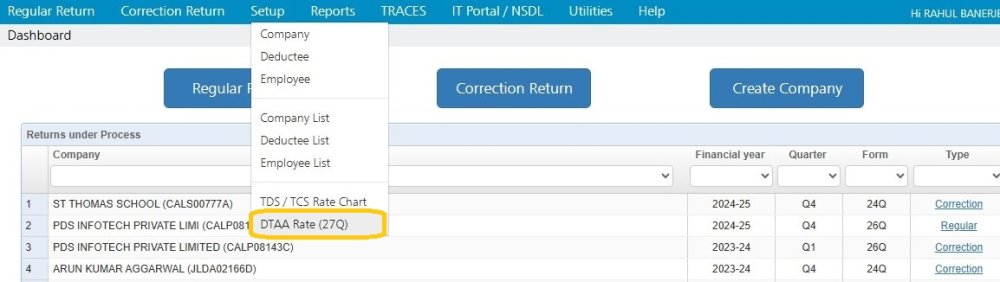

In order to do so click on ‘Setup >DTAA Rates(27Q)’ as shown below :-

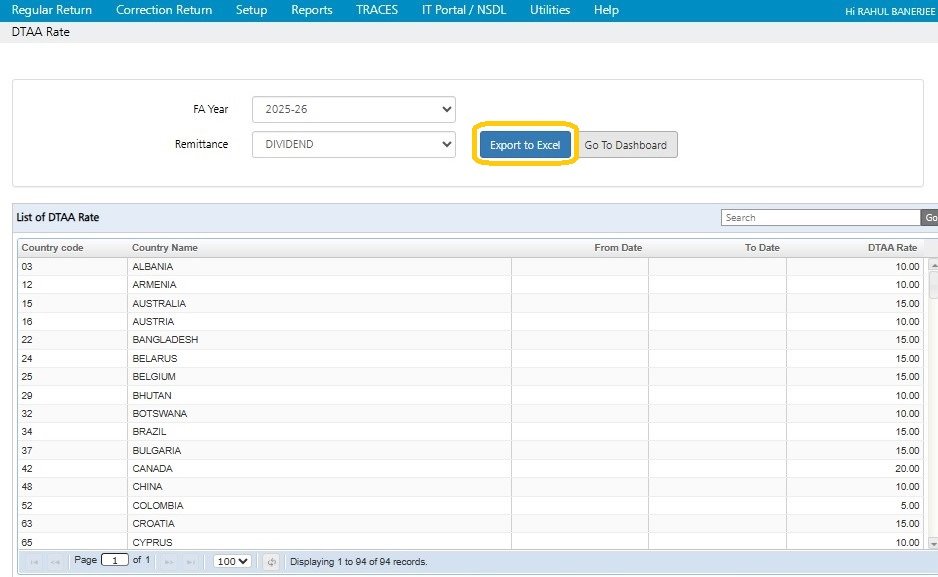

The following screen the default List of DTAA Rate will get displayed :

FA Year : Select the year for which the List of DTAA Rates needs to be displayed.

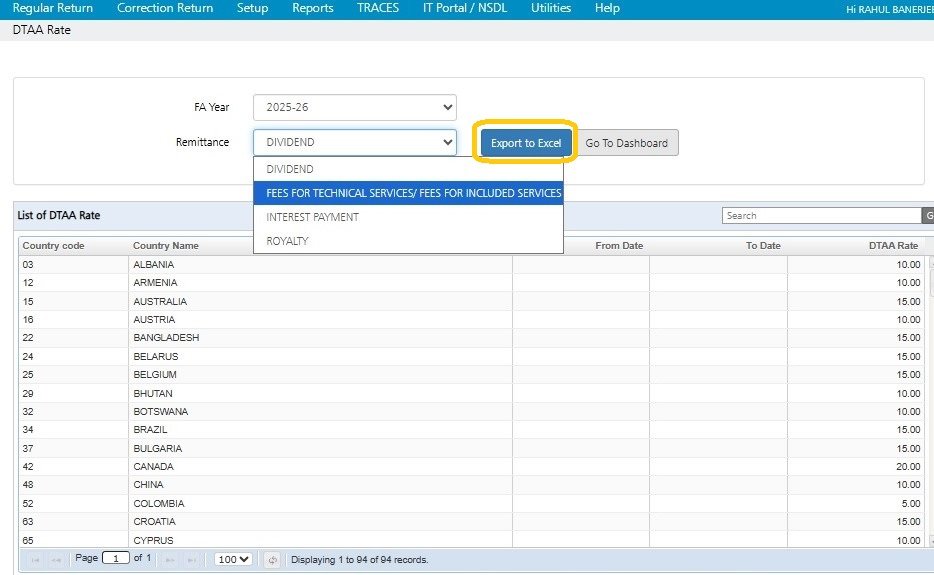

Remittance : Select the specific Remittance for which the List of DTAA Rates needs to be displayed.

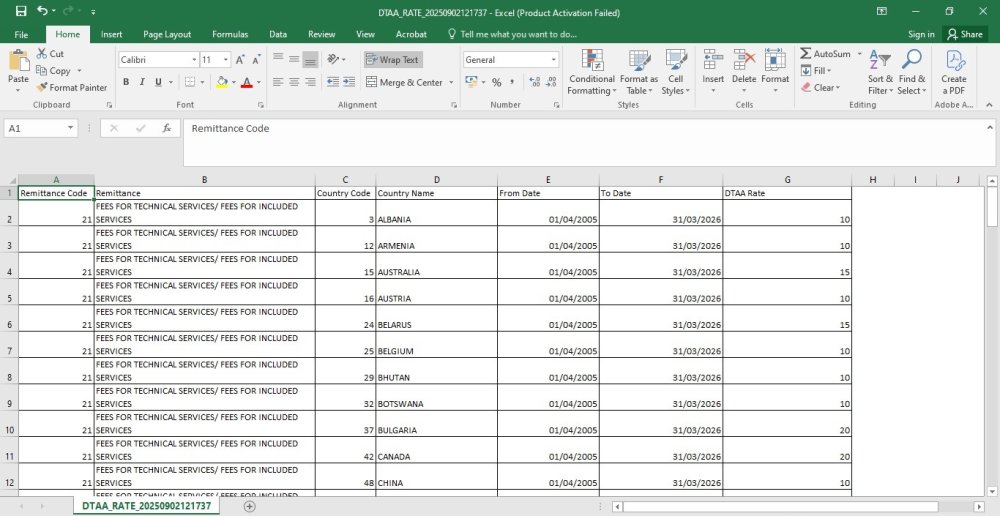

In order to export the selected DTAA Rate List to Excel, click on ‘Export to Excel’ .

The following screen will get displayed:

Need more help with this?

TDSMAN Online - Support