Once the Challan & Deductee details (and also Salary Details in Form 24Q – Q4) have been entered, the user can generate the TDS / TCS Return. Click on the Generate Return option:

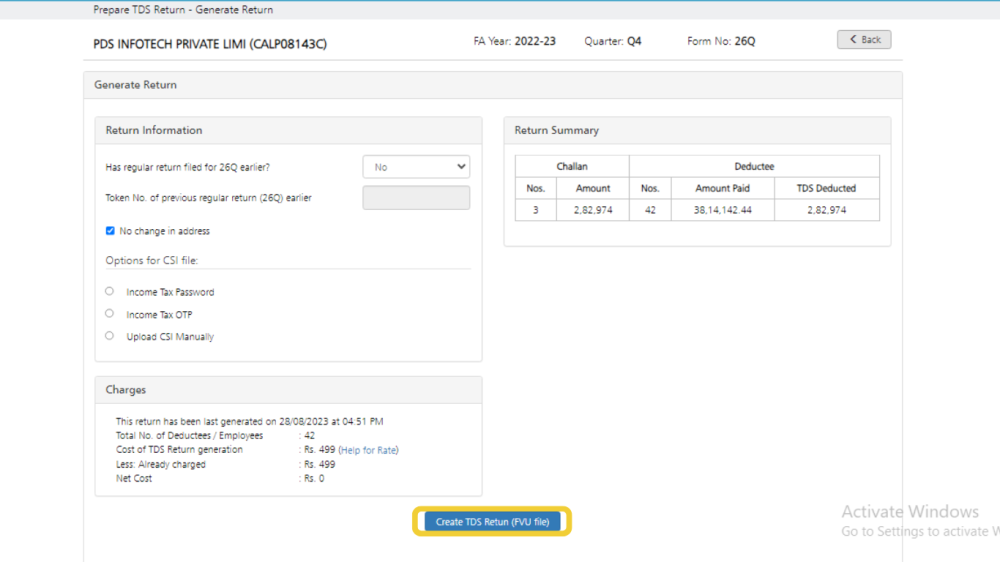

The following screen appears:

In the above screen, under the ‘Return Information’ section, specify the Token No. of previously filed return if there is any. Check the box for No change in address . In case of any changes in address of the company or the responsible person, the user has to ‘Uncheck’ the box and it must be specified.

The process of Generating TDS Return includes validating the Challan data and CSI file, provided by the Income Tax department.

The user needs to provide the CSI file through one of the following options:

- Income Tax Password

- Income Tax OTP

- Upload CSI Manually

Charges will be displayed for generating the TDS return, this cost will be adjusted with the Credit amount or one have to pay the sum amount, before the return can be generated

Click on Create TDS Return (FVU File) to generate the return.

Once the return is generated, one can download the ZIP File , containing the TDS FVU file. Form 27A can also be viewed and printed from here. A copy of ZIP with all the relevant files will also be sent over email. User can make offline submission of the return by taking print out of the FVU file or by using a pen drive as well. User can also submit the return through online, by uploading the FVU file to the Income Tax portal.

Need more help with this?

TDSMAN Online - Support