Online Challan Payment is a function in the Income Tax Portal. Integration from within the software has been done to directly access the Income Tax Portal for making such payments. A special multi-purpose utility ‘PDSConnection1.0’ has been developed by us for the purpose of connecting and accessing the Portal for different TDS / TCS functions including the online deposit (payment) of TDS / TCS.

To activate this function, following needs to be done before this module can be used:

- Download and install the utility ‘PDSConnection1.0’ – this is a onetime action (till a new version is not available)

- The utility needs to be running in the background (just click on the utility icon)

It is presumed, that the above has been duly taken care of.

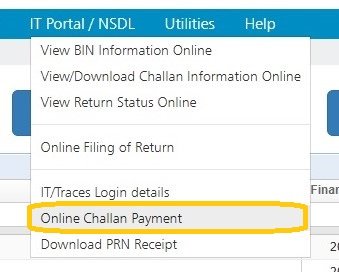

For making the online challan payment click on ‘IT Portal/NSDL’ > ‘Online Challan Payment’, as shown below:

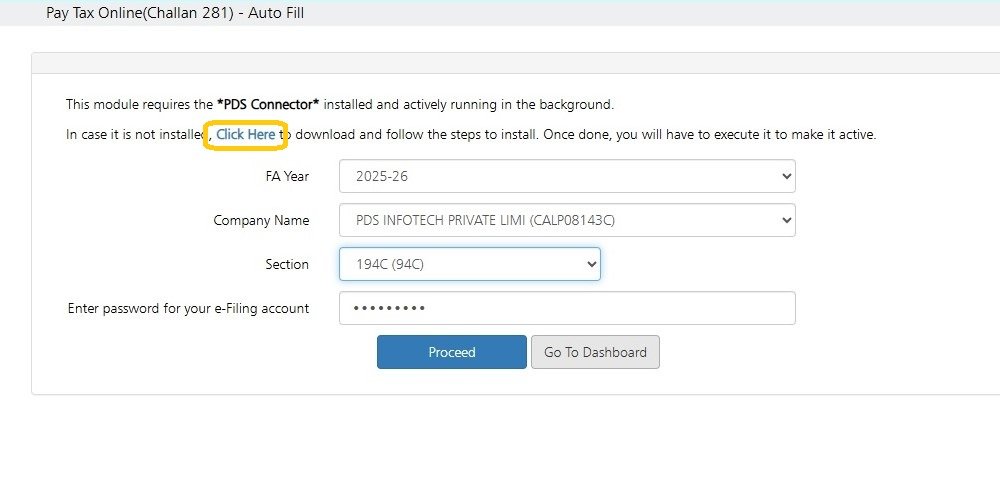

The following screen will get displayed:

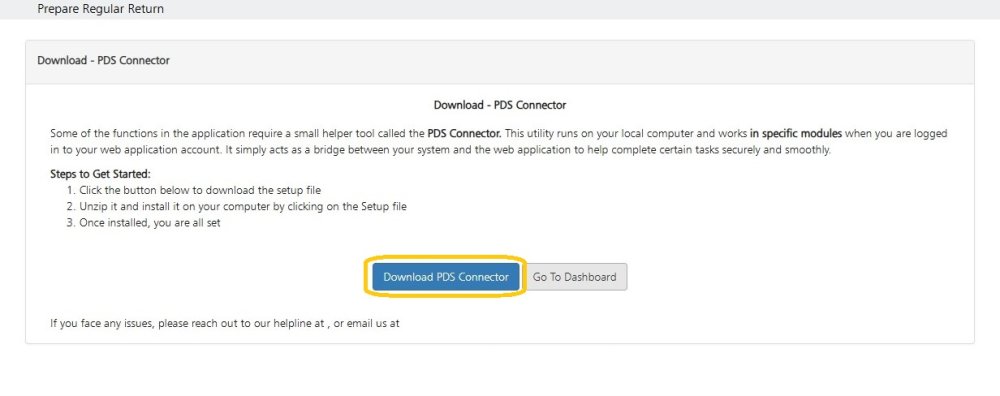

If required, click on ‘Click Here’ to download the ‘PDS Connector’ utility. The following screen will get displayed:

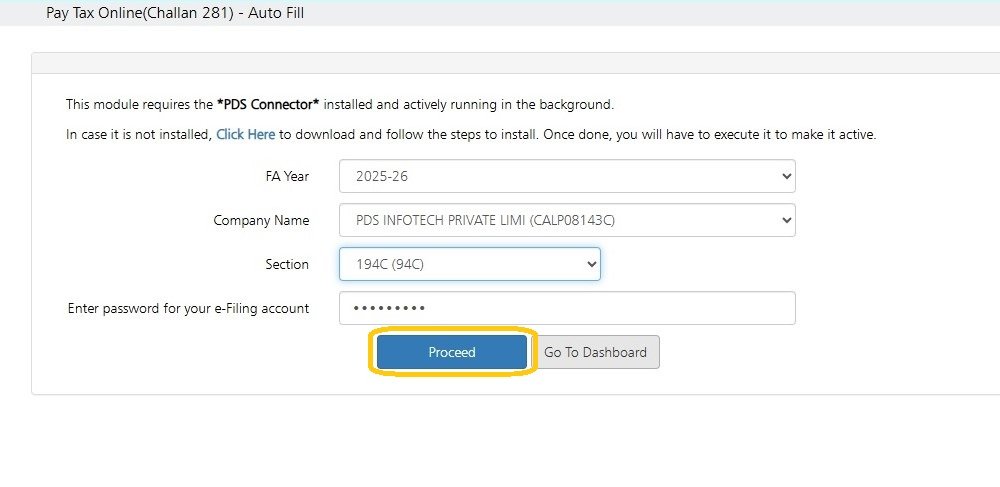

Once done go to the previous screen, the following screen will get displayed:

FA Year : Select the Financial Year

Company Name : Select the company name

Section : Select Section

Enter Password for your e-filing account: If the password has been entered earlier then it will appear automatically, else enter the password.

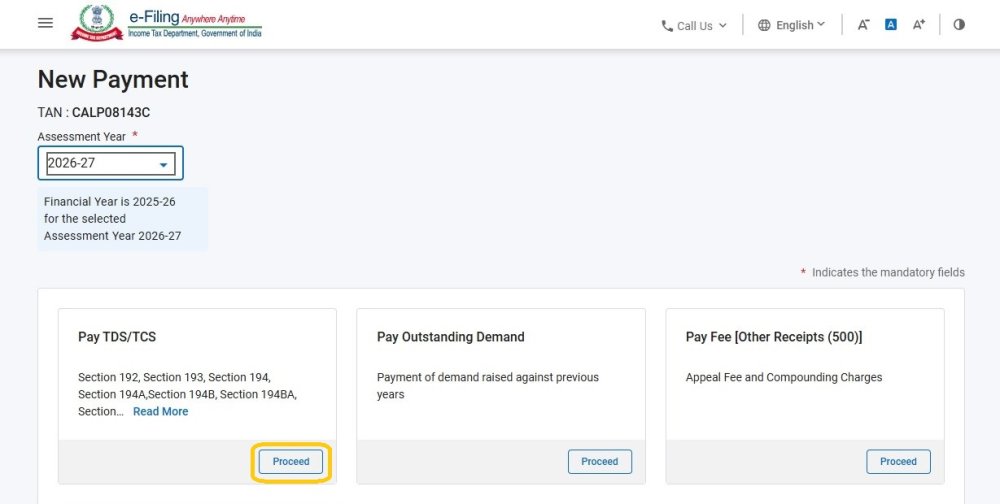

Click on ‘Proceed’, you will be logged into the Income Tax Portal and the following screen will get displayed :

Select the relevant option and click on ‘Proceed’. The following screen will get displayed :

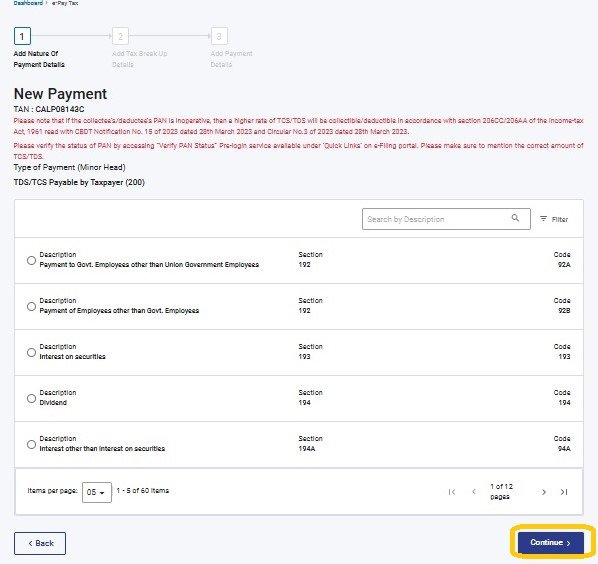

The system would be automatically guide through the Challan Payment Page. Select your Section and Click on ‘Continue’ , then Complete the payment.

Need more help with this?

TDSMAN Online - Support