Each filed TDS Return, is processed by the Income tax department to check for any irregularity or defaults. ’Predict defaults’ is a diagnostic tool to determine the possible errors & defaults in advance for taking corrective measures, before filing TDS Return

i. Short Deduction – These are the errors, related to lower tax deduction for a deductee, which is determined on the basis of PAN, Section and remarks.

ii. Late payment –Default owing to Late Payment is delayed deposit of TDS to the IT department either through Challans or Book Entry. This error normally attracts interest.

iii. Late Deduction – This implies that, the delay in deduction of tax as per the provisions. Typically, this attracts interest based on the date on which, tax was to be deducted and actual date of deduction.

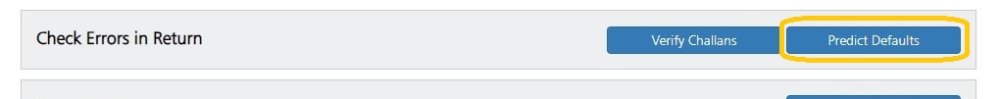

This will also calculate Late Fee for filing the return. Select Predict Defaults option

The following screen will appear:

As above screen, by clicking the View button, user can see all the possible defaults he made, while generating the return. If any error is visible, the user needs to take corrective actions and update the TDS data accordingly.

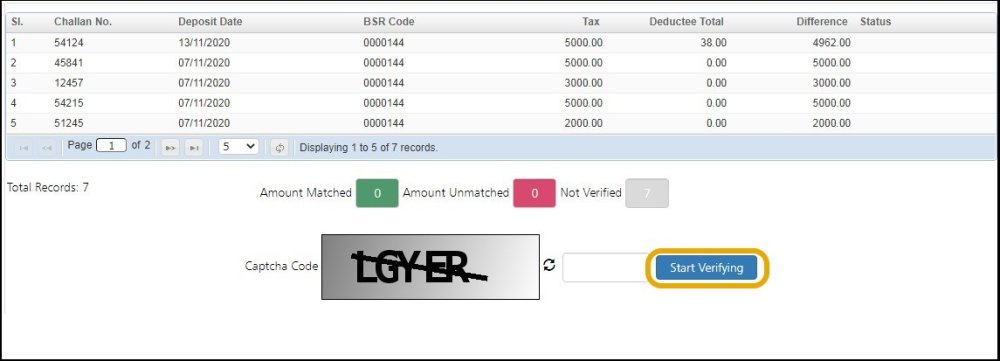

Challan Check – For Security reasons, ‘Captcha’ code has to be entered while checking the Challan details . Then click on Recheck to check on possible error in your return.

Following is displayed below:

In case of first attempt of checking defaults in Challan, Start verifying option will be visible instead of Recheck

Following is displayed below:

Need more help with this?

TDSMAN Online - Support